5G for Growth & Survival – Why Telco’s need 5G

Telecoms service providers have long been reliant on new technologies to sustain and grow their business. Will 5G provide a longer term sustainable growth model?

Telecommunications / communications services providers (CSP) are mostly consumers and integrators of technology, not developers of technologies. So they highly reliant on the introduction of new technologies as a way to sustain and grow their business.

The significant investments unique to telco’s are in their physical network infrastructure and BSS / OSS IT systems. The BSS / OSS systems provide customer management, order management and billing solutions required to monetise the network and assure that service reliability meets customers expectations.

This this is Part 2 of my posts on 5G, providing a business model view of 5G. See Part 1 - An Introduction to 5G Architecture for more details on the 5G architecture model.

Here we will look at how 5G can provide a more sustainable future for the telcos.

Telecoms Market View

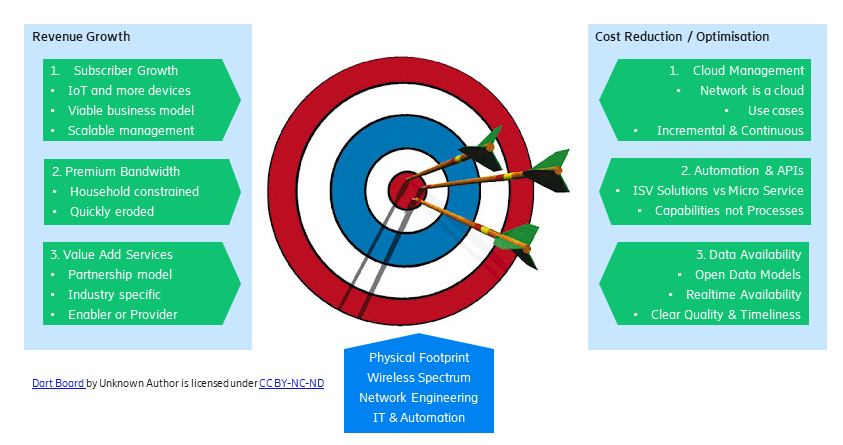

There are significant variations in growth and value perception amoungst the numerous participants within the Telecoms maket. The following market valuations illustrate this for:

- Apple – the handset provider

- Amazon – the web scaler and Over the Top (OTT) provider of everything.

- Accenture – the SI service provider to many Telcos

- Cisco – the largest network equipment provider

- Ericsson – the wireless infrastructure leader

- AT&T – the big CSP

- Telstra – the Australian CSP

- Amdocs – the telco OSS/BSS software provider

- Goldman Sachs – the investment banker (just for cross industry comparison).

We can see the A's of Amazon, Apple and Accenture here, so where are the core telcos in this picture? Here they are:

This illustrates what many in the telco industry know, that there is generally better growth in value added services than in core telecoms services. Of core telco stocks Cisco (equipment) and Amdocs (software) are showing best long term sustained growth, Ericsson is showing strong recent growth (no doubt driven by 5G wireless anticipation) and CSPs AT&T and Telstra are roller coasters.

So will introduction of 5G help the telcos move from roller coaster ride to a more sustainable upward trajectory?

Historical & Financial Context

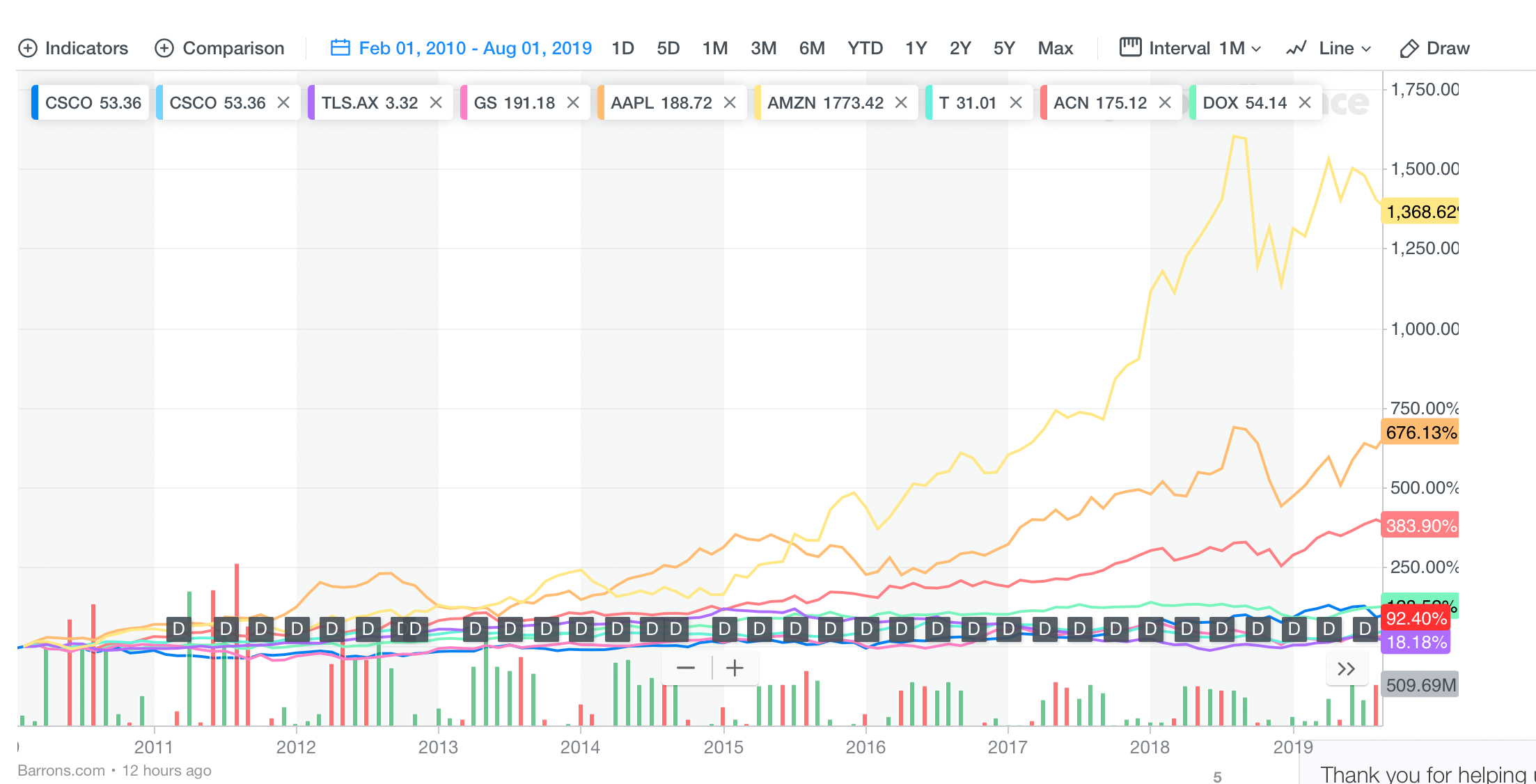

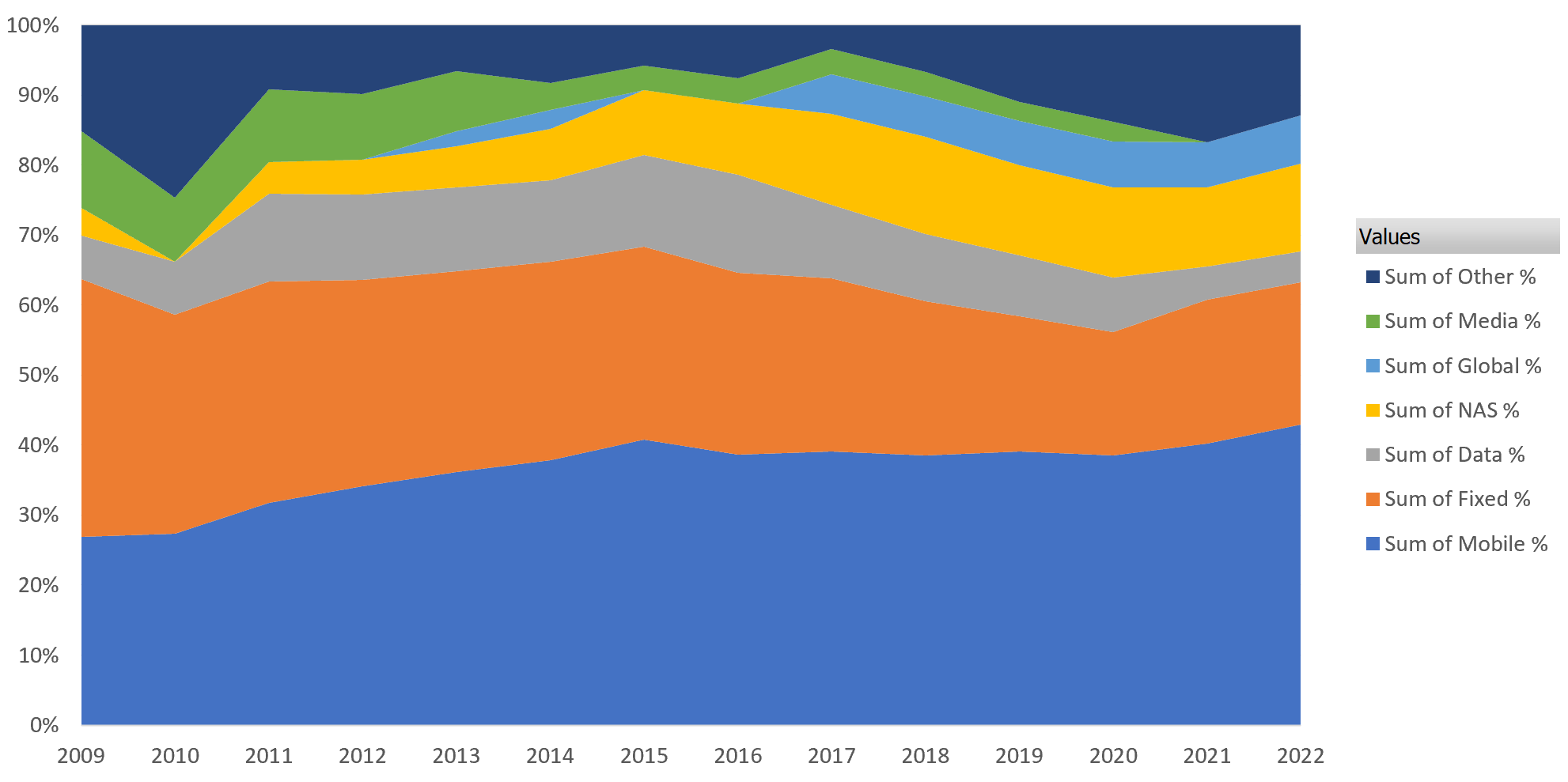

Before looking at 5G, let’s look at some historical data. Here is 10 year revenue reports, taken from public records, of a large Australian telco:

In summary, over the last 10 years revenue has been essentially flat to declining (non CPI adjusted AUD $ 25,500 M to 27,800 M to 2019 and declining to 2022) with consumer growth out weighing other areas and wireless are being only consistent growth provider (going from around 29% to 40% of revenue).

NOTE: Jumps in allocations with Segment view are due to variations on reporting within segments where small business has moved to/from business/enterprice and consumer reports.

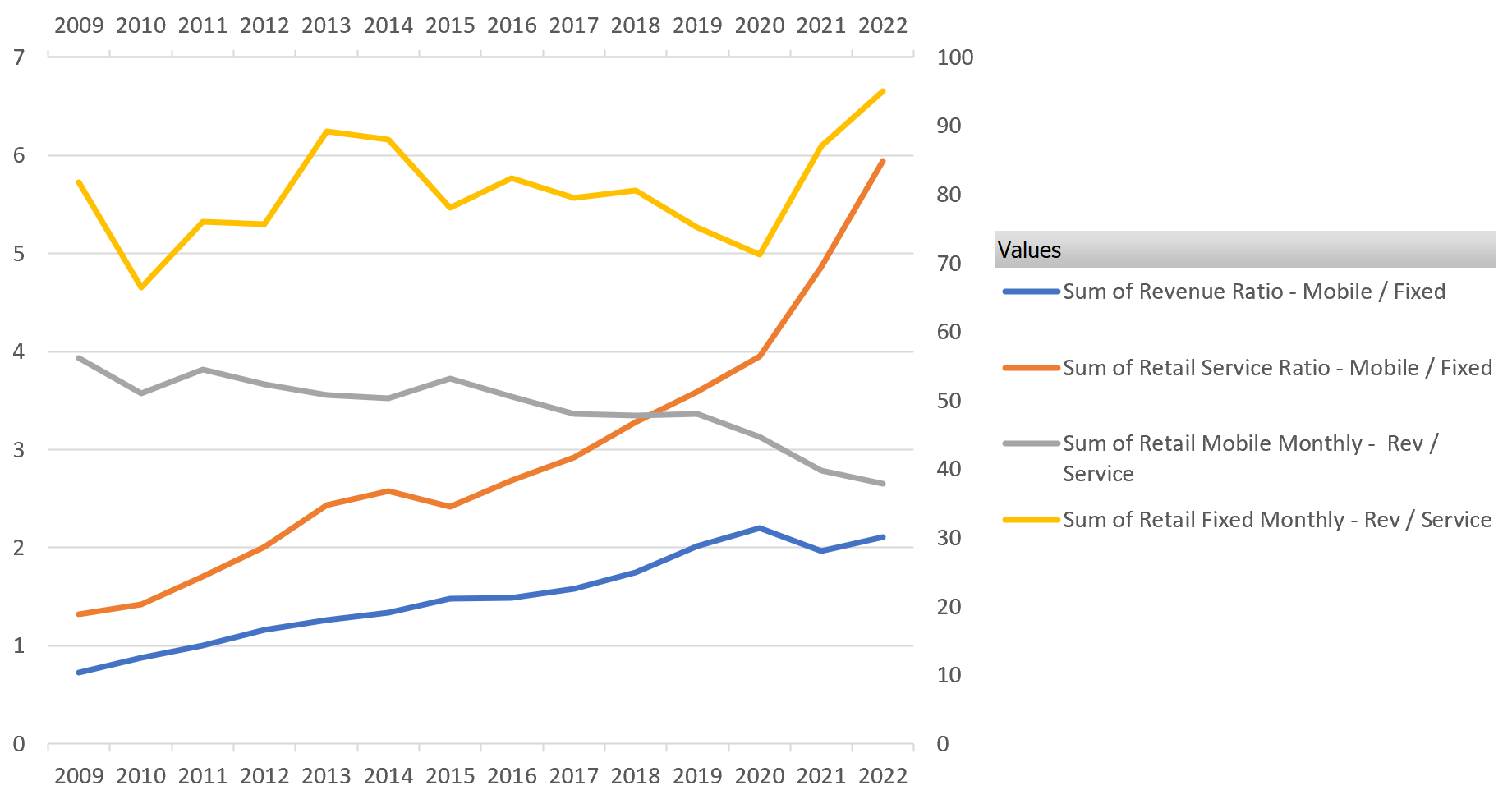

Wireless growth is primarily driven by subscriber growth not ARPU (average revenue per user) growth:

Observe the ratio of Revenue (Mobile / Fixed) vs Ratio Retail Service (Mobile / Fixed), which illustrate that is it the 3 x growth in number of services which is compensating for drop in ARPU. While these numbers are specific to an Australian Telco, a recent Ericsson market report shows similar trends across broader telecoms market.

NOTE: For the curious you can look at the ratio of Income / Expense and which also shows decline, due to increasing supply costs (iPhones ;-) and other smart handsets) and salary increases. All these factors contribute to margin squeeze on Telco.

How can 5G change things…

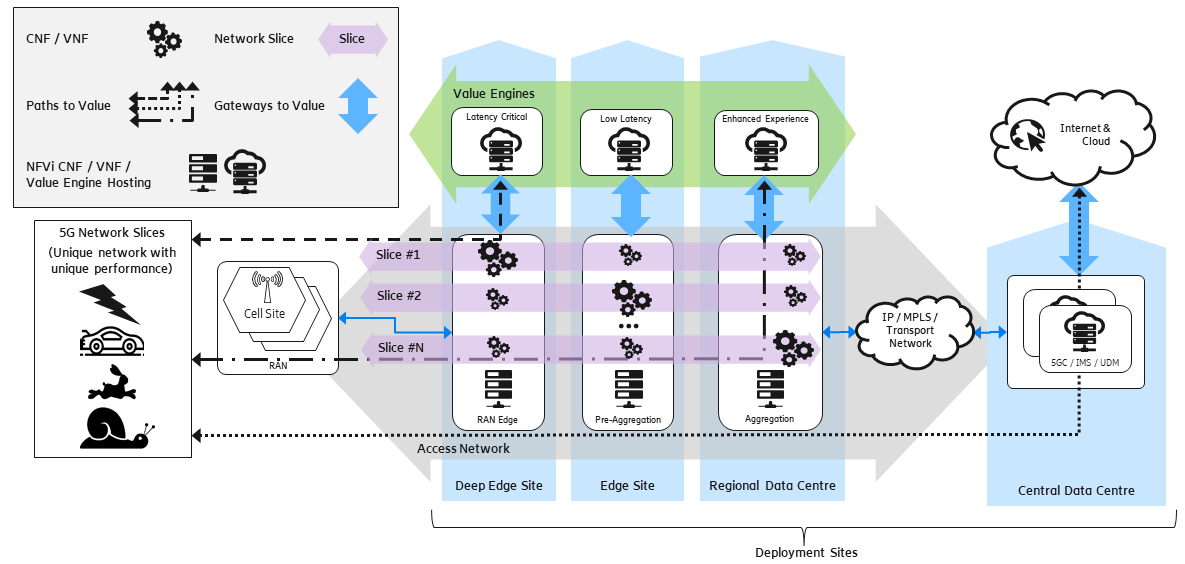

Here is a “simplified” illustration of 5G Architecture:

The 5G architecture uses CNFs (Cloud Native Network Functions) / VNFs (Virtual Network Functions) for all the 5G Core networks functions. These are deployed on distributed Cloud Native NFVi (Network Function Virtualisation Infrastructure) platforms.

The 5G architecture has some unique capabilities and characteristics including:

- All 5G Core network functions are provided by: Container (cloud native) based software

- Cloud Native Distributed NFVi environments are used for deployment of 5G Core network functions

- Cloud Native Value Engines are use to deploy the Value Functions within the Wireless Network

- Network Slices allow sharing of physical infrastructure and cost / performance optimised deployment

- Alternate Paths to Value allow cost / performance optimised architectures via Gateways to Value (CNFs/ VNFs) for access to Value Functions, providing "Over The Top" (OTT) services within the network rather than at central Points of Interconnect (POI) at Data Centre sites

- The architecture is managed dynamically through orchestration and automated network management and

- 5G is able to provide bandwith that can directly complete with fixed HFC and ADSL based technologies (as delivered via nbn co in Australia).

So 5G has some signifant difference from prior LTE / 4G and these differences can be used to build new services and open up new revenue opportunities.

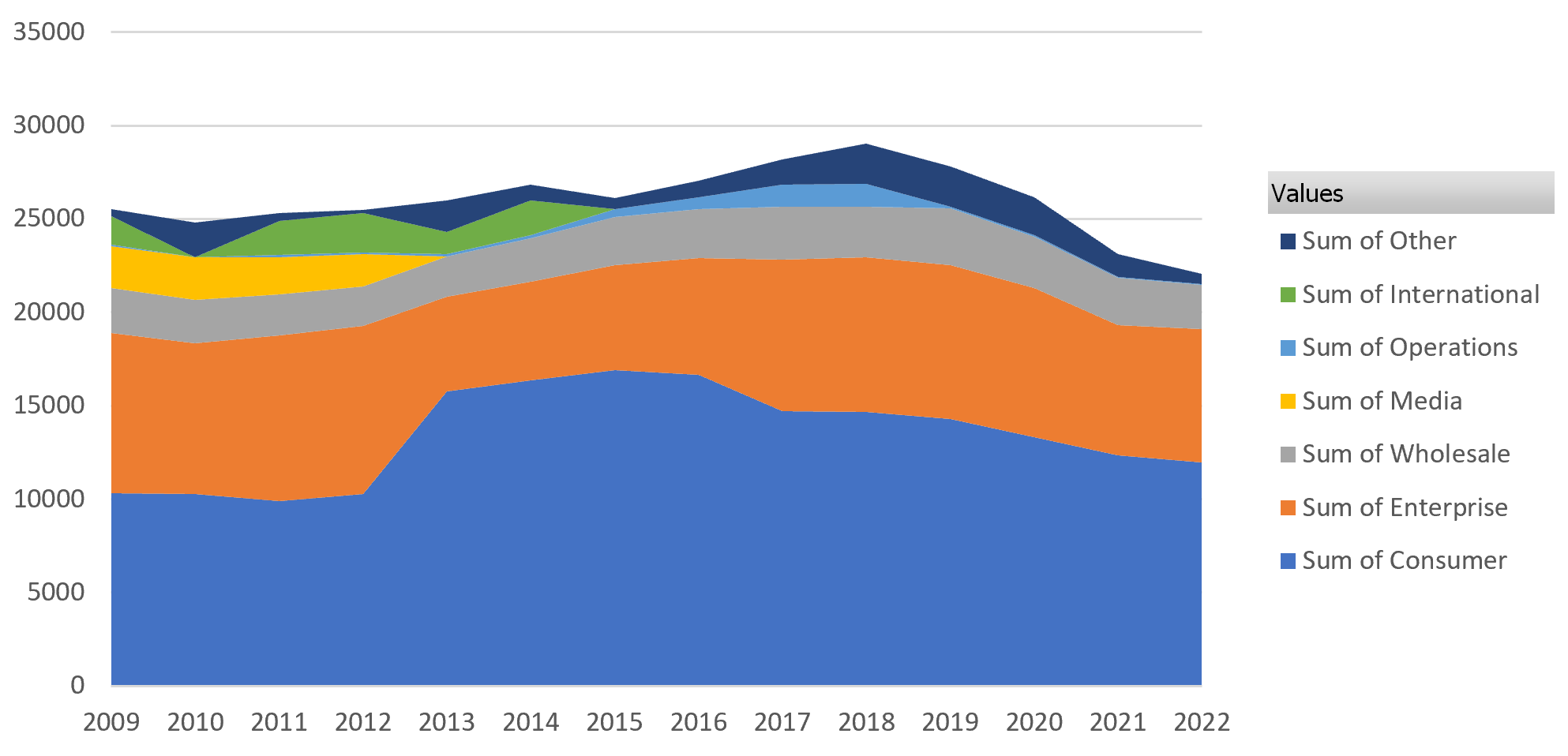

5G Business Model & Posture

What posture a telco takes to achieve revenue growth can vary dependent on the scope of revenue ambition and their ability to have highly efficent operations.

As an entry point into 5G the telco provider needs to have:

- Physical Footprint - as key feature of 5G is that it provides capability to deploy value add functions within the wireless access network. To leverage this requires access to physical sites for deployment of cloud infrastructure

- Wireless Spectrum - essential for service provision and to cover cost of this telcos need to squeeze as many services as you can onto purchased spectrum. With 5G slices CSPs you can also use slicing to provide sharing of infrastructure, rather than current model of doing competitive overbuilds (a model the Economist thinks could make sense). In USA a spectrum band has been defined for "Citizens Broadband Radio Service" (CBRS). This completely changes the way spectrun is made available and consumed (think App store for spectrum) and makes spectrum available as a commodity service

- Network Engineering - this is what network operators (not Virtual Network Operators) are historically good at. They have deep and extensive network engineering skills and these are essential to build and operate large distributed networks

- IT & Automation - the 5G Core and its ability to provide Slicing and Value Function deployment means that IT & Automation are now essential skills for 5G success. To productize 5G slices and Value Function deployment will require new Orchestration solutions, as initially described by ESTI Management and Orchestration (MANO) framework. Within CSPs these skills have typically been within the OSS/BSS teams run by CIO (or Chief Digital Officer) rather than network operations. Historically telcos have gone through cycles of out/in sourcing this work and are highly reliant on Telco Equipment Manufactors (TEMs), Software Providers and System Integrators (Ericsson, Nokia, Amdoc, NetCracker, Cisco, Accenture and Infosys to name a few). The 5G architecture is built on top of Cloud Native software and principles. So the 5G CSP now needs to have deep Cloud Management and Web Scale Software skills to manage its 5G network and products.

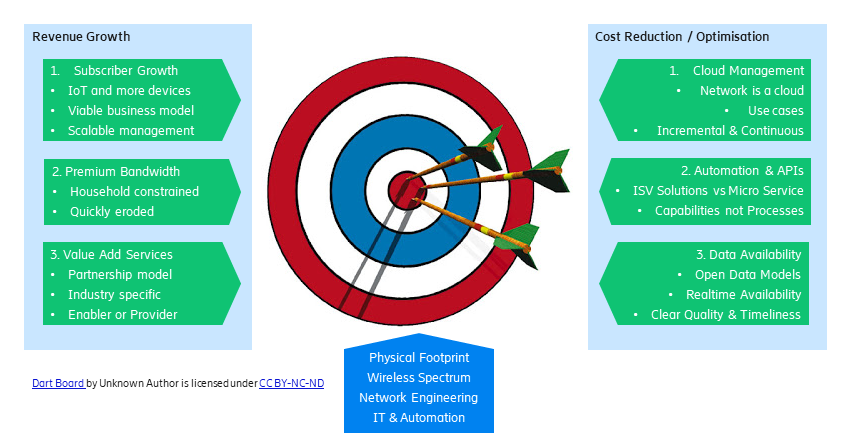

The paths to revenue can then be highly varied but in simple terms revenue growth will like be from:

- Subscription Growth and Device Sales - due to growth in connected devices: smart meters, cars, infrastructure, fixed line and private radio network substitution and hand set upgrades. This growth is likely be be sustained for some time and the extent of a providers network foot print will be key determinant in realizing many of Internet of Things (IoT) review avenues.

- Premium Bandwith - charging for premium bandwidth. This is likely to be a short term boost as competitition across providers means this premium will get discounted rapidly over time and trend will shift to historical ARPU decline. This is wireless repeating it prior history of new subcriptions due to mobile device up take compensating for ARPU decline (see "Historical & Financial Context" above)

- Value Add Services - this is the major new revenue stream that is opened up by 5G. Example services include: gaming acceleration, IoT instrumentation, in car entertainment, drone control and our automous vehicles. The Ericsson market compass report provides a comprehensive survey of candidate use cases. The enabler for these is 5G Slicing and Value Function deployment capabilities. These allows 5G to displace on premise IT functions and delivery this via Value Engines that are deployed within highly distributed mobile network. The CSP can operate in this market in a number of ways: as Value Provider where the CSP provides the value added services; as a Value Engine Provider where the CSP provides the Edge Value Engine into which the Value Provider can deploy their application (think of this an Edge Cloud Provider model) and; as Rent Collector where the CSP rents space for Value Provider or Cloud Provider to deploy there own cloud infrastructure at the edge and provides the connectivity to wireless access network and back haul to Internet. The stance that a CSP takes will be dictated by the particular product use case and needs to be accessed on a case by case basis. By looking at a broad set of possible use cases the CSP might choose to adopt a consistent stance that supports its ambition and capabilities.

As illustrated in "Historical & Financial Context" Telcos have been working in a environment of declining margins driven by flat revenues and increasing costs. To counter this it is important that the gains in revenue are met with improvements in efficicency. The main enabler for this is IT and Automation. The key focus areas for this are:

- Cloud Management - all of 5G Core, the Value Functions and the Service management functions will be run on top of Kubernetes / CNFC defined substrate. So the capability to build and manage Kubernetes Clouds is critical to for deployment of these services. There are three different Clouds: 5G Core Cloud, Service Management Cloud (for OSS / FCAPS) and Edge Value Engine Cloud (for Value Function Deployment). Telcos needs to consider how each of these will be provided and supported.

- Automation & API - efficient operations requires automation. To automate require access to API, data availability driven and a continuous automation process. One of stumblings blocks to this is that to justify automation it needs to have "large" impact, but selecting a "large impact" use case means it requires larger investment and more planning to realise. An automate everything mind set targets all cases can and should be automated and not doing so just creates a backlog for future repair.

- Data Availability - intelligent automation (ML and AI) is only possible when data is available. In telecoms having rich inventory and topology based data sources is a key enabler for automation.

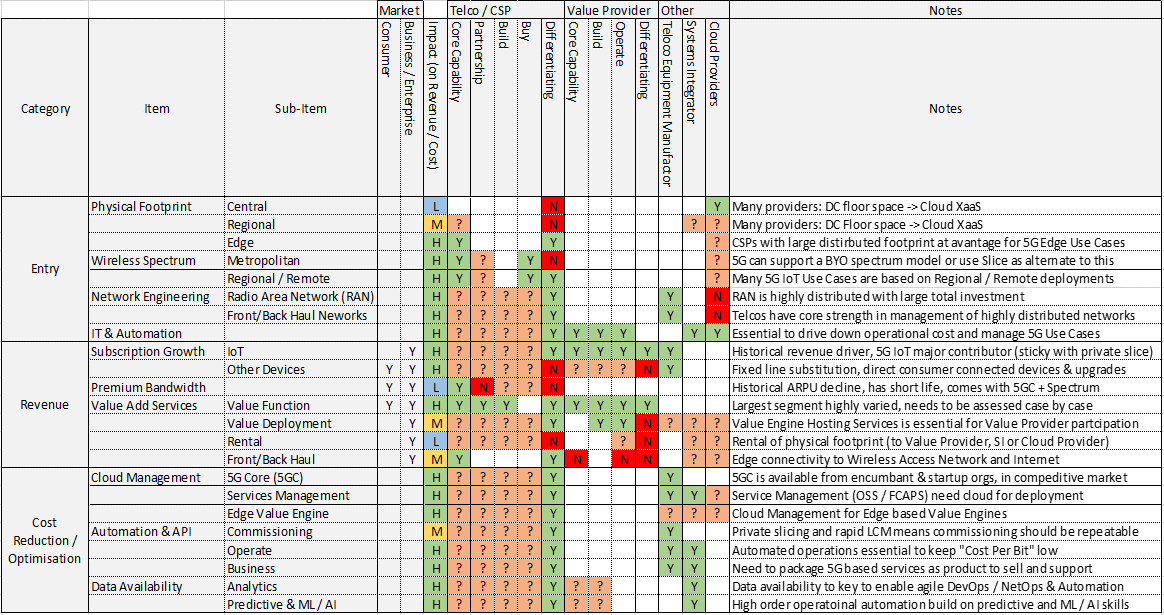

A summary view of: Entry, Revenue & Cost Reduction / Optimisation capabilities is provided below. The individual Telecoms providers need to review the candidate products and market for these and then determine which best matches their capabilties now and which will require new capabilities to be developed.

Key considerations to be resolved include:

- Which products and markets to target and in what timeframe

- What they will do themselves and where they will partner with Value Providers, Telecommunications Equipment Providers, Systems Integrators and Cloud Providers

- Where they need to build new skills

- Which investments will have most impact and

- Which are core capabilities and key differentiators

My example is sparsely populated with lots of "?". The reason is that the answer will not be same across all providers as some might have large physical footprint and others might be more advanced in their Cloud Management capabilities. The set of capabilities defines a base for use in "spider" or "skyline" analysis to help with gap determination.

One of the opportunities that 5G bring to the Telcos is to provide a platform that allows Value Providers to bring to market new Value Added Services. This is the model that has been used by eBay, Apple, Amazon & Google and to be successful requires investment in Web and APIs that allow the Value Provider or Systems Integrator to readily deploy there Value Functions into the network. This can be a win-win for both the Telco and the Value Provider.

So to close off, will introduction of 5G help CSPs move from roller coaster ride to a more sustainable upward trajectory?

The answer is yes, in worst case the telcos can expect a revenue boost driven by IoT devices count ramp up leveraging private network slices for a simpler business model. In best case by either being a Value Provider or operating a Platform for Value Providers (or both) there are a huge number of future revenue use cases that 5G can enable.

So Telcos please start your engines... the 5G starting gun is going and 5G Core and other capabilites are moving from labs to validation testing to production deployments.

References & Links:

ARPU - Average Revenue Per User, a favourite benchmark metric for telco revenue performance. Historically this declines over time for a given services and telco's have to offer more to maintain the same ARPU. In 5G context substiture User for Service or Subscriber as this is the likely growth driver.

BSS / OSS - the IT systems and process the support telcos business and service operations. These systems are typically domain of Telco CIO and are described by TmForum through its Framworx models. OSS overlaps with ITU FCAPS framework but comes from IT top down perspective.

FCAPS - Fault, Configuration, Accounting, Performance & Security framework defined by ITU network management model of telco and typically the domain of Telco CTO and Network Engineering teams. Overlaps with TmForum eTOM, but comes from network up perspective

OpenSignal WiFi (home) vs Mobile Bandwidth - supports that contention that Mobile (5G) communications will provide higher bandwidth than WiFi in future

A National 5G Wireless Network is not such a Stupid Idea - the Economist sharing a rare view that maybe having a state controlled solution is the best option. Key message is that using 5G slices avoids need for network over build

nbn abandons plans for 100 Mbs Fixed Mobile - Bill Morrow's express position to Senate Commitee that cost of 100 Mbs Fixed Mobile is not economically viable

Vodafone searches for the 5G Spot - Economist review of the value of Wireless Spectrum

Citizens Broadband Radio Service - CBRS defines a new set of radio spectrum and how this can be consumed. If this model is adopted across more countries then it will have very large impact on provision of IoT and other services and the telco's market positioning

The hard truth about innovatives cultures - HBR article on organisational culture required to innovation

Ericsson 5G for business - a 2030 market Compass - a review of possible market opportunties for 5G and recommended reading for any interested in broader survey of 5G product use cases

Australian Wage Slowdown - Parliamentary report

Kubernetes and Cloud Native Computing Foundation (CNCF) - Google developed Kubernetes to orchestrate Docker Container based workloads and then seeded this to the Open Source community. This provides the Cloud Native substrate that all of 5G is being build from.

HBR Piplelines, Platforms and the New Rules of Strategy - provides review of how platforms based businesses have generated revenue by fostering eco-systems that connects consumers to providers

Platform Revolution: How Networked Markets Are Transforming the Economy and How to Make Them Work for You - with 5G Telco's have the opportunity to provide a platform for Value Providers leverage their network and be a partner in delivery of new value and revenues

Telco Inventory & Topology - Enabler for Automation - my blog post on central and critical role that inventory & topology data has is supporting Telco processes

SK Telecom and Ericsson complete end-to-end 5G standalone core test - Ericsson 5G Core is moving out of lab and testing and into production

Ericsson and Telstra achieve container-based commercial Evolved Packet Core milestone - another example of 5G rapidly become real and use of Cloud Native container technology

ESTI MANO - MANagement and Orchestration a framework describing how Virtual Network Functions (VNF) are instansiated and managed.

Icon Analogies & Credits:

- Snail - your current 3G, 4G, LTE Architecture has Wireless Access Network terminated at POI, which provides Gateway to Value

- Hare - 5G option for better experience with shorter Path to Value than traditional wireless architecture

- Racing Car - 5G option for low latency applications with short Path to Value for critical functions

- Lightning (MS Powerpoint) - 5G option for latency critical (Ultra Reliable Low Latency Communicatons - URLLC) shortest Path to Value for our favourite 5G enabled use cases including "automonous cars", "control networks" etc

- Dart Board - by Unknown Artist is licensed under CC BY-NC-ND